Planning to buy a property anywhere in India? It’s an exciting step, but you need to be careful! Some sellers defraud buyers by hiding the fact that their property is mortgaged, and buyers only find out when the bank or lender claims the property after the sale. You can stay safe by checking for any loans on the property before making a purchase.

For just Rs 10, you can protect your property investment against such potential frauds.

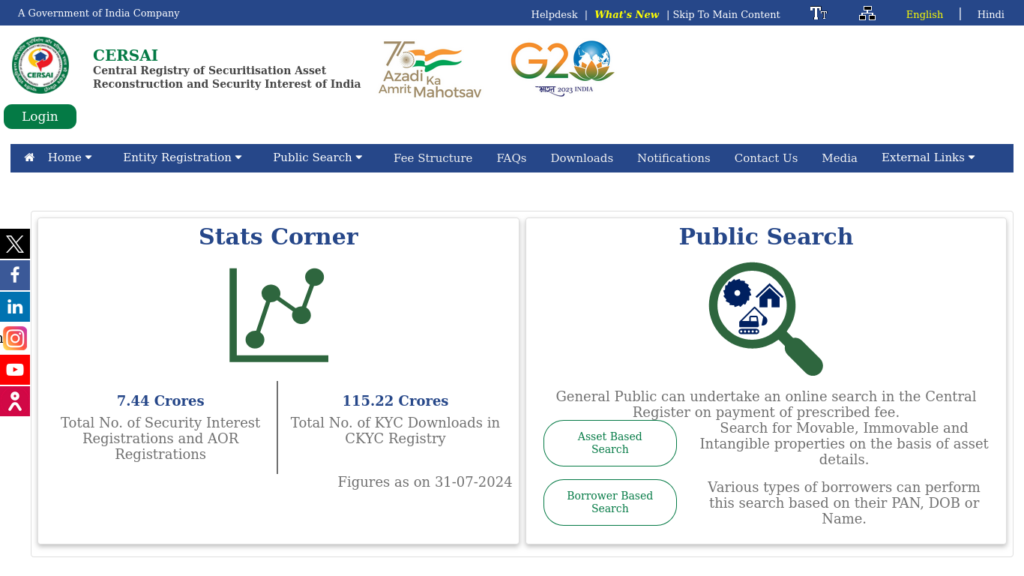

In India, banks and financial institutions have to report mortgages to CERSAI (Central Registry of Securitisation Asset Reconstruction and Security Interest of India), which in turn makes this information available to people.

Using the CERSAI website’s public search tool, you can find out if a property has any loans against it.

Why Check for Mortgages Before Buying?

When someone takes a loan against a property, the lender holds the right to claim the property if the loan isn’t repaid. Sellers may hide this information to push the sale. If you unknowingly buy such a property, you end up in a financial and legal mess.

To protect yourself, you can quickly search the CERSAI website to see if the property or its owner has any loans registered with a bank or lender.

How to Check for Property Loans Using CERSAI?

The CERSAI website lets you search for loan information using either borrower details or property details. Follow these simple steps:

Search by Borrower Details

If you know the seller’s information, you can check for loans linked to their name:

- Visit cersai.org.in.

- Choose the “Search by Borrower Details” option.

- Enter the borrower’s name, PAN, or date of birth (DOB).

- The search results will show any loans associated with the borrower, including properties used as collateral.

This option is useful if you suspect the seller may have multiple loans or mortgaged assets.

Search by Property Details

If you have specific information about the property, you can directly check for any loans:

- Go to the CERSAI website (cersai.org.in) and select “Search by Property Details.”

- Enter details like the property address, property number, or apartment name.

- You’ll see if the property has been mortgaged and which lender holds the claim.

Is There a Fee for the Search?

Yes, CERSAI charges a small fee for generating search reports. As on 15 October 2024, there is a nominal fee of Rs 10 and GST. After making the payment, you’ll get complete details, including the loan amount and the name of the bank or lender. This small step can save you from major problems later.

Stay Safe and Avoid Risks

Before buying a property, always take time to check if it is mortgaged. A quick CERSAI search can help you avoid legal troubles and financial losses. Whether you’re buying in Delhi, Noida, Gurgaon, or Greater Noida, make sure this property loan search is part of your due diligence.

Don’t let hidden loans ruin your real estate investment. Use the CERSAI public search tool to verify any loans or mortgages on the property. It’s a simple step that offers peace of mind and ensures your property purchase is safe and sound.